OTTAWA, Aug 31 ― Canada announced yesterday tentative deals with Volkswagen and Mercedes-Benz that would see the two European automakers tap into burgeoning North American supply chains as they seek to challenge Tesla in the electric vehicle market.

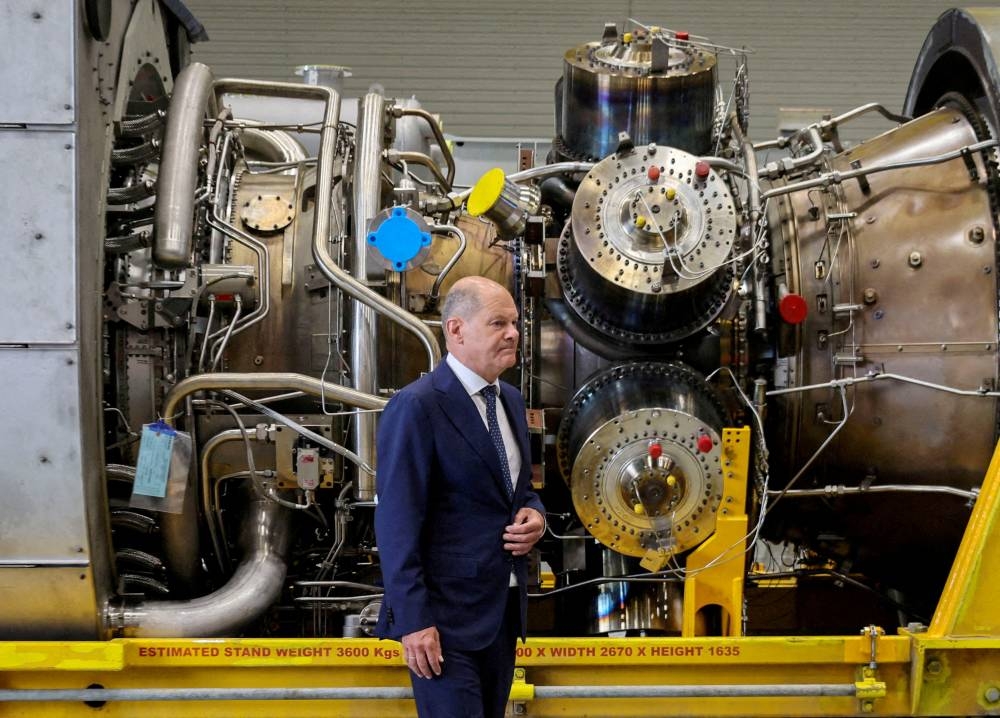

The memorandums of understanding were signed during a visit to Canada by German Chancellor Olaf Scholz, who is seeking to firm up access to new energy supplies for Germany and deepen bilateral trade ties.

The agreements “will help us meet growing demand, both here at home and around the world, for electric vehicles,” Canadian Prime Minister Justin Trudeau tweeted.

Scholz commented in a statement that the cooperation, notably in the securing of critical battery inputs such as lithium, nickel and cobalt, “may encourage other companies to follow.”

Mercedes-Benz said it envisages partnering with Canadian companies across the electric vehicle and battery supply chains, including Rock Tech Lithium for the supply of up to 10,000 tonnes of lithium hydroxide annually, starting in 2026.

The Volkswagen agreement specifically focuses on the production of battery precursor and cathode materials. Volkswagen's newly-formed battery company PowerCo will also open a Canadian office.

“Working hand in hand with governments around the world is an absolute prerequisite to meet our climate goals,” Volkswagen chief executive Herbert Diess said in a statement.

“The supply of battery raw materials and the production of precursor and cathode materials with a low carbon footprint will allow for a fast and sustainable ramp-up of battery capacity ― a key lever for our growth strategy in North America,” he added.

The deals come on the heels of several other agreements announced by the sector, including by Stellantis in March to manufacture batteries for electric vehicles in Canada.

Ottawa meanwhile has boosted its support of domestic exploration for critical minerals used to make electric vehicle batteries. ― AFP

Source: Malay Mail

A word from our sponsor:

Need Help With Your Personal Finance / Money Issue or need a coach to help you structure or just want to learn the financial skill to self manage your financial matters and retirement. iLearnFromCloud.com

Need to solve a problem quickly, now you can solve it by learning the art of problem solving Art Of Problem Solving

Feeling hungry. Latest food news from Best Restaurant To Eat Malaysian Food and Travel Blog

Memory loss. Need to organize better. Solve problem fast with Free Mind Mapping Software Mind Mapping 101

Need A Customized System Development for your business or Going Paperless XPERT TECHNOLOGIES - Empowering The Paperless Economy